Top 10 tricks used by Agents for misselling financial products

Buyers Beware. This is the mantra one has to follow in Indian financial markets. From last many years agents and so-called “Financial Advisors” are using fancy words and tactics to lure investors and sell them inappropriate products like wrong Mutual funds,ULIPS, ULPP’s and Endowment Policies. In this article we will see what are the common tactics used by agents and how we should handle them and demand logical explanation. Note that this is not an exhaustive list and there are many more miss-selling techniques which is not covered here. Lets see them one by one.

1# High Dividends declared by Mutual funds.

This is very common tactic used by agents. Even the mutual fund companies advertise about big dividend payout to lure investors. Investors who do not how mutual funds with dividend options work fall in the trap thinking that dividend is something extra which they get apart from growth, where as the reality is that dividend is your own money which comes back to you and then NAV goes down by that much quantity. Have a look atDifference between Growth and Dividend option in Mutual funds

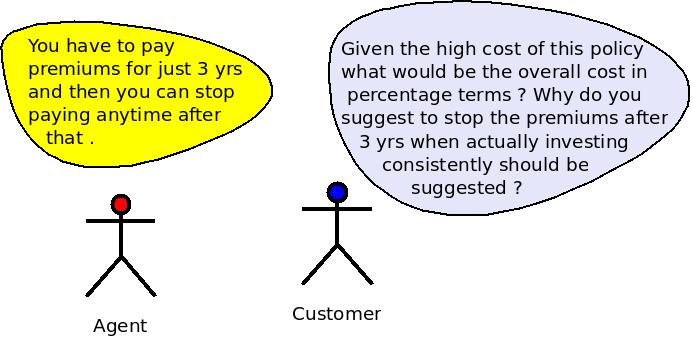

2# Premium can be stopped after the first 3 years

This is a very effective statement because every investor wants “no trap” investment option, hearing that we just have to premiums for 3 yrs and still our insurance cover and policy will keep running makes us interested in these products. There are two wrong things here: Firstly, ULIP premiums can be stopped even before 3 yrs, there is just lock in period of 3 yrs, even some agents don’t know that you can stop the premiums of ULIP’s anytime after 1 yr and you won’t loose 100% money, the other thing is that advising paying premiums just for 3 yrs is wrong thing as ULIPs are long-term products and should not be used for short term. This is against the basic principle of any equity related product.

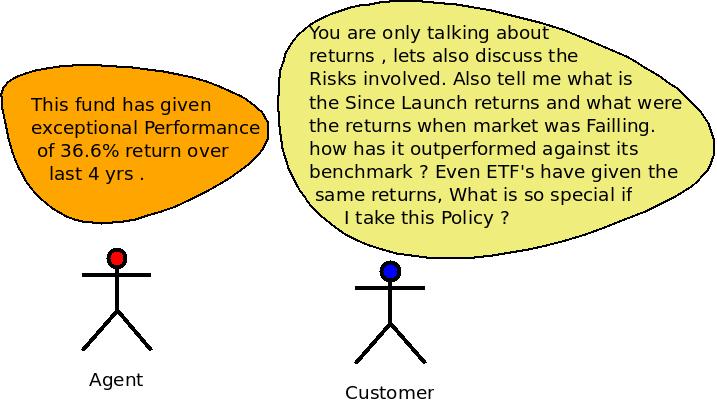

3# This fund has returned 36.6% annual return in last 4 years

Last 4-6 yrs have been extremely good for Indian markets and performance of every mutual funds , ETF or Equity linked product has been great. This single most fact has been used by agents and they have been advertsing about the “great performance” of their respective ULIP’s and mutual funds . What one has to really look at are the returns a product has provided over and above its benchmark or other peers . If Nifty has given 40% return and a mutual funds with bench mark as Nifty has given 41% , there is nothing great in this . In fact its better to use Nifty ETF’s then and get 40% return without the fund manager risk and other costs associated with Mutual fund . We should also ask the agent about the performance of product in bad times and not just good times .

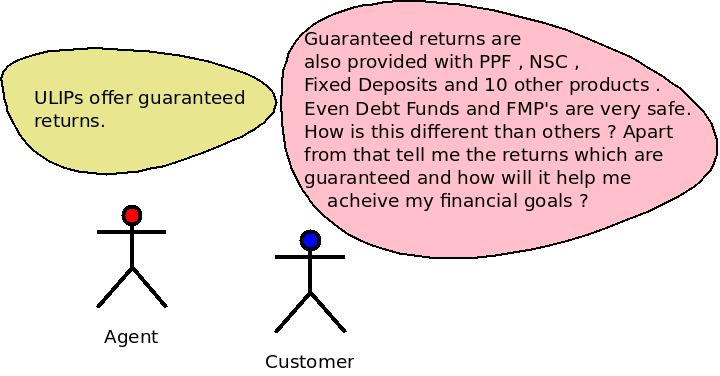

4# ULIPs offers guaranteed returns

This is not true! Any Unit Linked product does not come with Guaranteed returns. Agents some times just say this to attract customers and moreover their Greed! There might be the case that there is some guarantee for initial years premium or over all but then it will be so low that its not even worth considering. A simple thumb rule is that anything beyond Bank FD returns will always carry some level of risk otherwise why will someone buy FD at all if they can get some guaranteed returns. Nothing comes free in this world, there is always some risk involved.

[ad#big-banner]

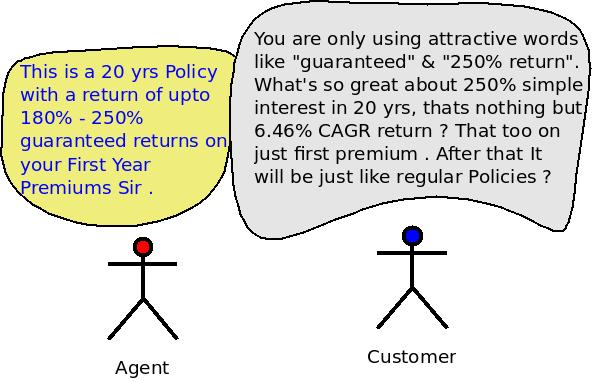

5# This is regarding 180% – 250% guaranteed return plan Sir.

Now a days I can see this strange thing with most of the products, that they have started giving “guaranteed returns” with first year premiums. This has two reasons, people in India like words like “guaranteed” and “secure” especially at times when markets are doing bad, second reason is that they can use these words at the time of promoting their products, I get a lot of calls which start with “Hello sir, this call is regarding 250% guaranteed return plan sir, Can i explain it to you?” I can sense that sense of pride in the caller’s voice clearly when they say this even though they dont know whom they are talking too. My first question to them is “Just tell me the IRR of this policy” and then starts the process of “wait sir, let me transfer the call to my senior” and then “wait sir, Let me transfer the call to the regional manager and CEO” who have no idea what is IRR!!! Finally

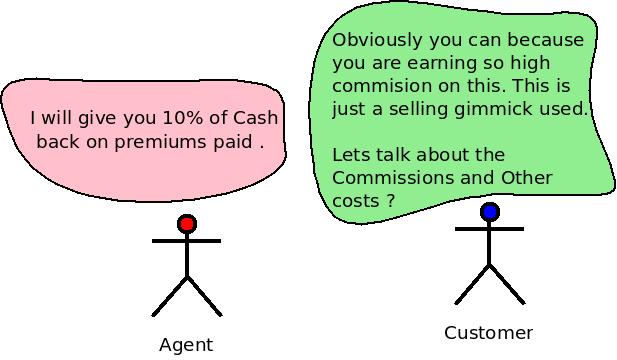

6# I will give you 10% of Cash back on premiums paid .

ULIPs and an endowment plans have very high commissions in the first year [See a case of miss-selling in ULIP]. So agents lure customers by giving back some part of their commissions back, in this way they get more clients and more money overall. Don’t fall in trap of this. Many agents also offer to pay your premiums for 1 yr so that you fall into the trap and take the policy.

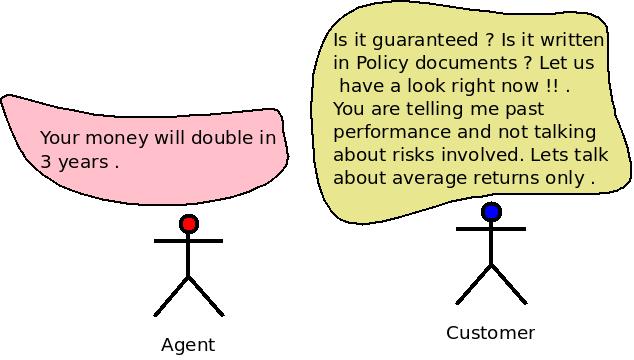

7# Money doubling in three years

[ad#link-unit]

This is again based on past performance, ask for the average rate of return over long termand anything above 15-16% should look unrealistic. Many agents tell the illustration by taking 20% or as high as 30% as return, they will show your last 5 yrs data when this has actually happened, but its not a right thing for 2 reasons. First reason is that as per IRDA they are supposed to show you illustration with 6% and 10%, nothing other than this. Ask the agent to explain why they are showing you anything other than 6% or 10%. The other reason is that 20% and 30% are not realistic returns from equity in very long run, you should not expect more than 12-15%. see this article which explains what are the realistic long term returns from Equity

8# You also get Free Insurance and Tax Benefit.

“Free”, we love this word. You can see that even I have used this word at the top of the page right hand side of this page to lure visitors to subscribe to this blog. It works in most of the cases. There is nothing called as “Free Insurance”, most of the investors do not understand how insurance works and what are the terminologies, they don’t know that there is something called as “mortality charges” which we have to pay as cost of Insurance. Apart from this agents also stress on tax saving part which is not something which is unique to those products. We have tax savings on different products anyways.

Dont forget to grab your Free Ebook by Subscribing to this blog by Email or RSS.

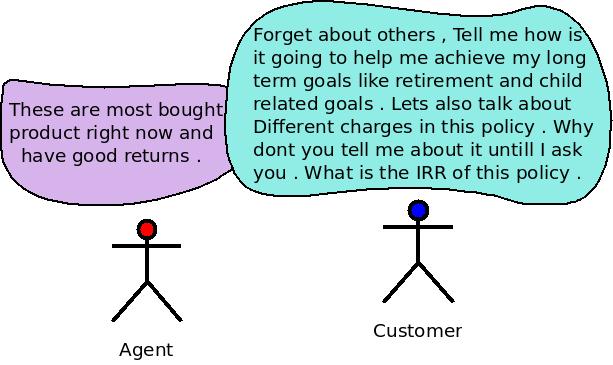

9# These are most bought product in the market and have good returns .

Now this is vicious circle, ULIPs are around 70-80% of the products sold by Life insurance companies these days, the reasons are simple. They are explained by agents in such a way that things looks so rosy that customers feel its a worth buying product. So agents pitch these products to other investors and then they feel “if everyone is doing it then it should be right thing“, far from the actual and real truth. Common sense is not common, so don’t do what others are doing just blindly, think about it yourself, evaluate it. You should rather be doing what very less people do. Buy Term Insurance which is not even 1-2% of policies sold  .

.

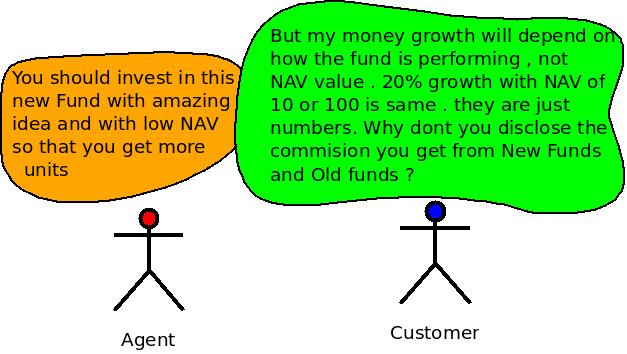

10# Low NAV of a NFO from mutual funds

Most of the NFO’s pay very heavy commissions to agents. This is the reason agents tell investors that they should invest in this mutual funds because they will get more units. Even Investors confuse NAV of mutual funds as share price of a company. At the end itsfund performance which should matter and not NAV number, truly speaking we should request IRDA to ban publishing NAV numbers. Some agents also lure investors saying that they should buy low NAV mutual funds because they will get more units and then more dividend as dividend is paid per unit basis. This is true but again at the end investor will not benefit as dividend is nothing but their own money.

This Article Credit Goes To Its Source Jaagoinvestor

No comments:

Post a Comment