Most people have such a fear of (lack of) money that they almost

equate money to oxygen. Cover someone’s mouth and nose and watch how

they fight you to get their air back. I came across T. Harv Eker’s Book

“The Secrets of the Millionaire Mind” it says “Rich people manage their money well. Poor people mismanage their money well”, I read this & my first reaction was, “As a Financial Planner I know that!” Trouble was I didn’t really know the effective system to manage money. I just thought I did.

If you want to get rich, focus on making, keeping, investing & managing your money. I had been managing my money for years but not in a systematic way, I paid price for the same (by not following any system). This Money management System is very simple to understand & implement. If you want Financial Freedom you got to follow a system for achieving it. As a financial planner people I meet believe managing money will take away their freedom. They hate the idea of Budgeting. They believe managing money will not allow them to be free and enjoy life to the fullest. I have been implementing this “Money Management System” for over a year now & it has given me tremendous freedom in the area of money.

Most of the people I meet say, “I will start managing my money when I have enough money”. As a planner I tell them “if you aren’t managing your money now then you may not have any money to manage in the future”.

The Single biggest difference between financial success and failure is how well you manage or mismanage your money. People mismanage money in different ways (By not having a financial coach in life, by not having a financial Plan in place, by not organizing their finances, by buying ULIPS, by not taking financial Literacy etc etc)

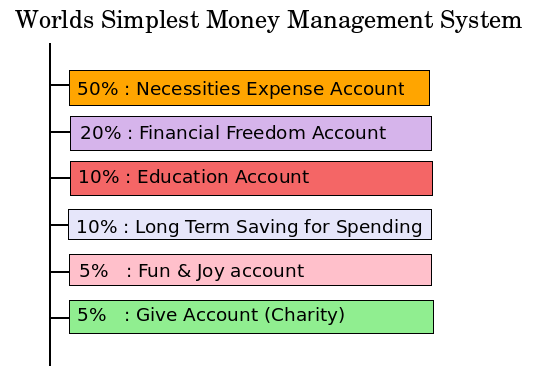

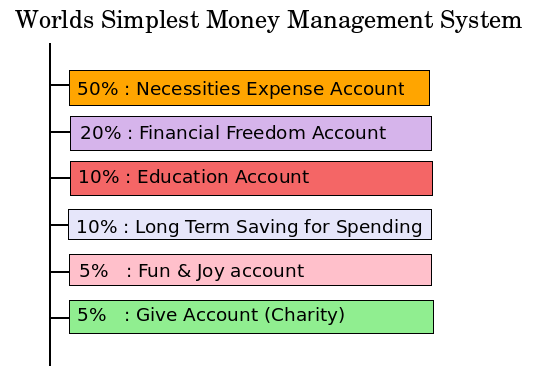

To master money, you must manage money through this effective Money Management System:

by

If you want to get rich, focus on making, keeping, investing & managing your money. I had been managing my money for years but not in a systematic way, I paid price for the same (by not following any system). This Money management System is very simple to understand & implement. If you want Financial Freedom you got to follow a system for achieving it. As a financial planner people I meet believe managing money will take away their freedom. They hate the idea of Budgeting. They believe managing money will not allow them to be free and enjoy life to the fullest. I have been implementing this “Money Management System” for over a year now & it has given me tremendous freedom in the area of money.

Most of the people I meet say, “I will start managing my money when I have enough money”. As a planner I tell them “if you aren’t managing your money now then you may not have any money to manage in the future”.

The Single biggest difference between financial success and failure is how well you manage or mismanage your money. People mismanage money in different ways (By not having a financial coach in life, by not having a financial Plan in place, by not organizing their finances, by buying ULIPS, by not taking financial Literacy etc etc)

To master money, you must manage money through this effective Money Management System:

- 50-% Necessities Expense account (Your Day to Day Expenses Account)

- 20% Financial Freedom Account (FFA Account only for investments. Never spend only invested)

- 10 % Education Account (Invest in skill development, Personal Development)

- 10 % Long Term Saving for Spending Account.

- 5 % Fun & Joy account (balance out the investing for fun % joy(nurture yourself – fine dining, etc)

- 5 % Give Account (To a lot of people wealth is how much you have. But if you truly want to create wealth, you might want to change that viewpoint. Try thinking of true wealth as how much you give.

A brief Definition of Financial Freedom

You are financially free when your Passive Income (Income from your investments, rental Income etc) is more than your desired lifestyle).To win the money game, the goal is to earn enough passive income to pay for your desired lifestyle. One should design their Financial Plan with a context to achieve financial Freedom. Having a Money Management System is equally important as having a financial. Always remember The real secret of successful wealth management is that your financial future is truly in your hands.by

No comments:

Post a Comment